The government has decided not to further delay the changes to IR35 and the Off-Payroll Working Rules (OPWR) as they did in 2020 so, if you are trying to make sense of some year-old+ notes to recall what it means, you are not alone.

HMRC originally introduced IR35 in 2000 to tackle ‘disguised’ employment. Compliance with the new tax legislation requires employers to be aware of these changes and take appropriate action (where needed) if individuals, contractors providing a personal service, feature anywhere within their organisation.

How does IR35 work?

IR35 uses tests of employment to assess people’s working practices for tax purposes and states who is responsible for carrying out the tests and for making the relevant Tax and NI deductions. These tests are very similar to those used in determining employment status just to make it more confusing!

What are the IR35 changes from 6th April 2021?

In short, under the new IR35, the Off Payroll Working Rules (OPWR) that currently apply to the public sector will be extended to the private sector unless you are a small business.

Small businesses are currently exempt from the OPWR changes, but IR35 still remains in play – if an individual contractor provides personal services to a small business in the private sector, the individual’s intermediary will remain responsible for deciding the worker’s employment status and will continue to make the necessary deductions. To be deemed a small business, the ‘end user’ (the Ltd/LLP business benefiting from the personal services), must meet two of the following criteria, for two consecutive financial years:

- Annual turnover of no more than £10.2 million

- balance sheet total of no more than £5.1 million

- no more than 50 employees

N.B. If the end user is a Sole Trader or Partnership, a slightly different criteria applies in determining if they are ‘small’ under IR35.

For medium and large businesses in the private sector, the upcoming IR35 and OPWR changes mean that:

- Private medium-sized and large businesses (with a UK connection) who receive the personal services from an individual will be responsible for working out and making the decision on the individual’s employment status for tax purposes. The medium or large business benefiting from the services is classed as the ‘end user’.

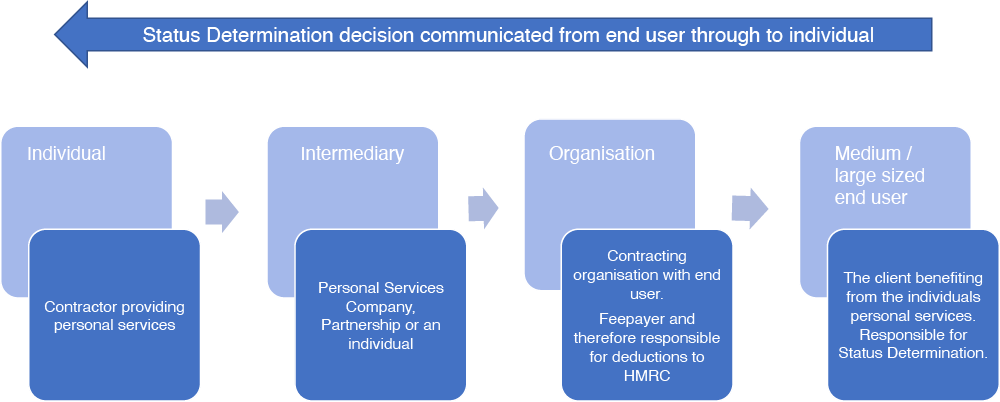

- The ‘End user’ (this applies to both private and public organisations) becomes responsible for providing a Status Determination to the individual which communicates the outcome and the reasons for the determination of their status. This Status Determination should also be provided to any contracting organisations to the intermediary to avoid becoming the ‘fee-payer’.

- Individuals can dispute the decision if they disagree with it and legally, the end user should provide a disagreement process to do this.

If I am not a small business, how do I make a Status Determination?

GOV.UK provides a useful tool to check the employment status for tax https://www.gov.uk/guidance/check-employment-status-for-tax

End users need to show they have taken reasonable care when working out IR35 status. If they haven’t, HMRC will hold them responsible for getting things wrong.

According to GOV.UK you may be affected by these new rules if you are:

- a worker who provides their services through their intermediary

- a client who receives services from a worker through their intermediary

- an agency providing workers’ services through their intermediary.

If the rules apply, the entity responsible for paying the intermediary, known as the ‘feepayer’, will be responsible for deducting the appropriate tax and National Insurance contributions to be paid to HMRC.

Further information on the changes can be found here https://www.gov.uk/guidance/understanding-off-payroll-working-ir35

Things to consider:

- Determine if are you an end user, intermediary, feepayer etc to understand your responsibilities under IR35 & OPWR. Below is an example diagram for your reference in which there is a contracting organisation in place.

- Identify all those working with you who may fall in scope of IR35.

- If you are an end user, will the services you benefit from be carried out on or after 6th April 2021? If yes, the IR35 rule changes may apply.

- The size of your business under IR35: does your business fit the criteria for being a small business? If so, breathe a sigh of relief first and then confirm this with your individual who is still providing services post 6th April. Remind them that the individual’s intermediary remains responsible for deciding the worker’s employment status and whether IR35 rules apply.

- Did you carry out any checks pre-April 2020? If so, review these. Your findings may still apply and therefore you don’t have to start from scratch.

- As the end user, have you spoken with the individual / intermediary about the up-and-coming changes and what this means for them on an individual basis? Speaking throughout this process will make it easier to reach a decision agreed by all.

- Ensure you carry out Status Determinations on an individual basis, every individual’s circumstances will be different.

- Don’t rely on just the contractual arrangements in place, you need to consider what is actually happening in practice too in order to determine an individual’s status determination.

- Have a disagreement process in place if you are the ‘end user’.

- Set an annual review before each tax year to see how the rules still apply to you, your business size or shape may have changed, and this may mean your responsibilities under IR35 have also changed.

These changes are complex, and you should always seek professional advice if you are unsure on what to do. PS Human Resources are on hand to offer advice and guidance on any people management issues. Try our new HR advisory service, a low-cost way to get peace of mind at the end of the phone. Please contact us on 01473 653000 or email hello@pshumanresources.co.uk for more information.